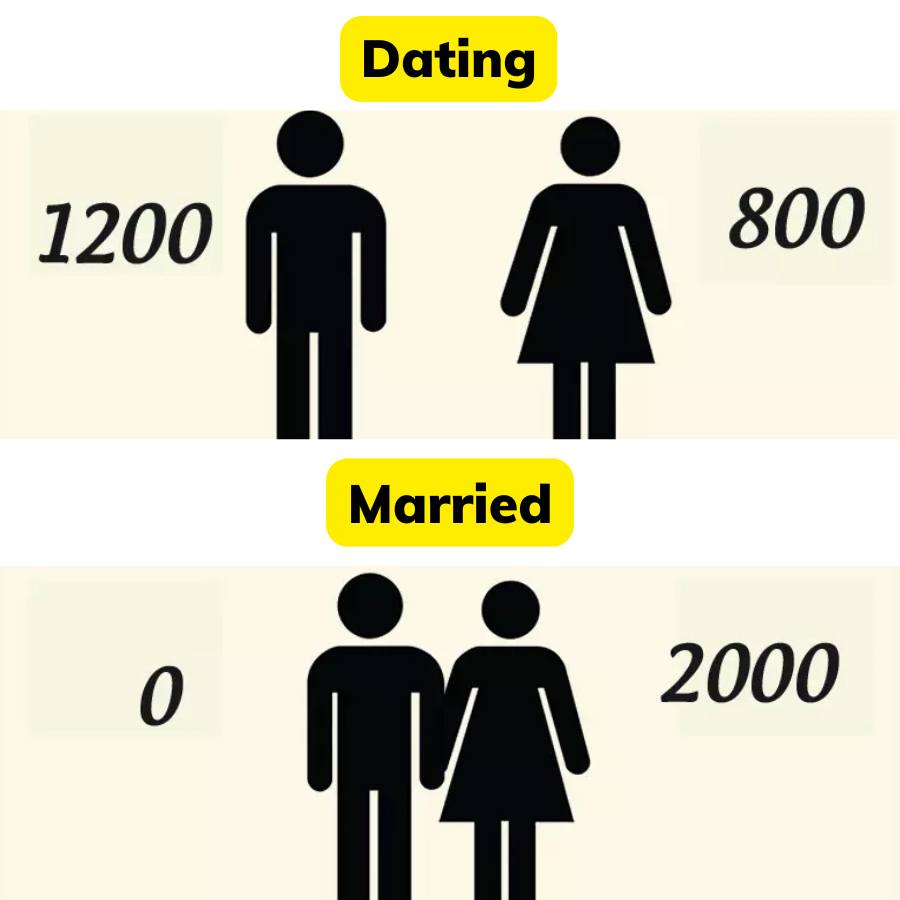

Money matters can significantly shift as relationships evolve from dating to marriage. Understanding these changes is crucial for building a harmonious financial future together.

5 Blog Post Titles to Spark Social Media Engagement

- “From Splitting Bills to Joint Accounts: How Couples Navigate Financial Evolution”

- “Love and Money: Transitioning Financial Habits from Dating to Marriage”

- “The Couple’s Guide to Merging Finances: What Changes After ‘I Do'”

- “Money Talks: How Relationship Status Influences Financial Decisions”

- “From Mine and Yours to Ours: Understanding Financial Dynamics in Relationships”

Understanding Financial Dynamics in Relationships

As relationships progress, financial interactions often transition from individual responsibilities to shared obligations. This evolution reflects deeper commitments and shared life goals.

Dating Phase: Individual Financial Responsibilities

- Separate Expenses: During dating, individuals typically manage their own expenses, maintaining financial independence.

- Equitable Sharing: Couples may alternate paying for outings or split costs to ensure fairness.

- Personal Budgeting: Each person adheres to their own budget, with discretionary spending remaining private.

Marriage Phase: Merging Finances

- Combined Incomes: Marriage often leads to pooling resources to cover shared expenses like housing, utilities, and groceries.

- Joint Financial Goals: Couples collaborate on objectives such as purchasing a home, saving for vacations, or planning for children.

- Shared Accounts: Many opt for joint bank accounts to simplify bill payments and savings, though maintaining individual accounts is also common.

Challenges in Transitioning Financial Dynamics

- Control Issues: Disparities in spending habits can lead to tensions if one partner is more frugal or extravagant.

- Financial Transparency: Full disclosure of debts and financial obligations is essential to prevent future conflicts.

- Budgeting Differences: Aligning on budgeting priorities requires compromise and open dialogue.

Strategies for Harmonizing Financial Practices

- Open Communication: Regular discussions about finances foster mutual understanding and trust.

- Establish Joint Goals: Setting shared financial objectives aligns both partners toward common aspirations.

- Maintain Some Financial Independence: Retaining individual accounts for personal expenses can prevent feelings of financial loss of autonomy.

- Seek Professional Advice: Financial advisors can provide impartial guidance tailored to the couple’s unique situation.

Conclusion

Transitioning from individual to shared financial responsibilities is a significant aspect of deepening a relationship. By maintaining open communication, setting joint goals, and respecting each other’s financial perspectives, couples can navigate this transition smoothly, fostering a stronger partnership both emotionally and financially.